Eligibility for Personal Loan in UAE

A personal loan is a great way to attain a variety of finance solutions and also benefits relevant to the loan. This type of loan is considered such loan that can bring peace and security in your life. It can secure your life by handling the issues that are prevailing due to a shortage of money. Lots of banks are here in UAE, that are serving as the best companions for all people including expatriates. Because expats are those persons who are not in a position to handle all their expenses and financial matters alone.

They need to get the other hand that can save them in case of any mishap in abroad. So, they find the banks as the most convenient way for handling all financial matters via their loan service. The most commonly asked question about a personal loan is, what is the eligibility for personal loan in UAE? So, if you want to know the answer to this question, read this article carefully. Because it contains all your required answers about this category of loan and you will gain much knowledge about it.

Main Characteristics affixed with a Personal loan in UAE

- Due to some urgent need of money people usually trust the banking system for loan services. Therefore, they try to get the most perfect loan service in the form of a personal loan to resolve their problem.

- Some medical emergency cases also need to be handled by attaining this type of loan. Because there is no other way to get the money from around. In this situation, banks played an important role and assist in medical emergency cases.

- Most expats contact banks to know about the eligibility for personal loan in UAE. Because they know this loan will facilitate them during the bad days that they spend far away from their homes, family, and friends. Therefore, they first search about the eligibility and after that take that loan with full confidence if they are falling into the criteria of that selected bank.

- Similarly, students and business owners are very much happy to have this facility in UAE. Because they both need loan to overcome their financial prevailing issues. Like students need to attain a student visa or they need to pay their university dues. On the other hand, business owners want to develop their businesses by putting some capital into business and by increasing productivity. Therefore, it is considered the most authentic source for all type of solutions.

Eligibility for a Personal Loan in UAE

-

Salary

If your minimum salary is up to 5000 AED, so you can easily get this facility of loan.

-

Age

The required mentioned age in the eligibility criteria is about 21 years for all expats and locals.

-

Emirate ID

Without your valid ID bank will not allow you to take a personal loan facility.

-

Visa and Passport

These two things are most important for all the foreigners living here. Bring the copies also with the original documents.

-

Bank Statements

The bank statements will be a must during the process, submit your 4 to 6 months old statements with the application form.

-

Salary Certificate

Another crucial document it is, without checking your salary certificate bank may not allow you this facility of loan.

-

Credit History

This history will also play a very important part and will create a good image of yours in front of the bank. The history should be clear and accurate.

-

Trade License

If you own a business on a small or high level, so you must bring your trading license or trade registration certificate along with you.

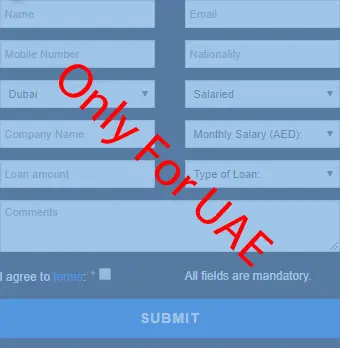

Hope! Now you have an idea about the eligibility for personal loan in uae. If you have any queries please fill out Karz.ae online loan application form or directly send message on WhatsApp at 0525063595