Loan without Salary Transfer in Dubai UAE

If you want a loan of any kind but don’t want to transfer your monthly salary directly to the bank of Dubai? Don’t worry, there is a solution to every problem and this issue is just a minor issue. you can find numerous banks in Dubai that are giving loan services with this facility. Now you don’t need to send your amount of salary directly to the bank. Banks in the UAE or the state of Dubai will take your willingness at the beginning of the loan application procedure.

If you do not want to transfer your payment of salary, so nobody can force you to do that. It’s all up to you whether you want a loan with a salary transfer or you want a loan without salary transfer. This article will reveal some truths behind this scenario and also explain the various banks that are giving such facilities in UAE. You will also see the answers to most of the questions, that people frequently asked about loans and without salary transfer loans.

UAE Top Banks Offer Loans without Salary Transfer in Dubai

If you are looking for such banks, so check out all these names of banks that existed in the UAE. This info will be useful for you while deciding about banks and loans.

-

Emirates NBD

According to Emirates NBD, the minimum required amount of your monthly payment should be at least 10000 AED. After checking the other details with salary, the bank will allow you a loan without salary transfer. The loan amount would be up to 500,000 AED.

-

City Bank

It is another bank in UAE, which will allow the loan with a minimum salary range of 8000 AED. The loan-giving capacity of Citibank will be almost up to 175000 AED.

-

Dubai Islamic Bank

The next one is DIB, which is based on sharia law. DIB provides loans with different amount of loans for both, the citizens and the outsiders. The minimum salary should be 3000 AED for both but the amount of the loan is not the same. For expats, the loan range will be up to 2 million AED and for citizens, it will be about 4 million AED.

-

Samba

It is Another bank that requires the amount of salary up to 10,000 AED and the amount of the loan is almost about 125,000 AED. So, it’s all up to you what UAE bank would you like to prefer for taking a loan.

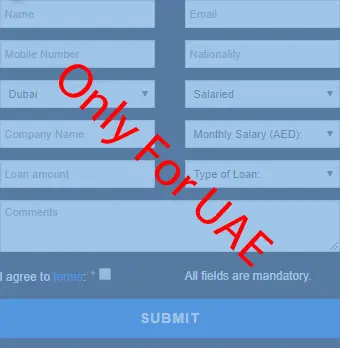

How Can Someone Qualify And What Be The Requirements?

To qualify for the bank loan in dubai, a candidate will have to understand a few things before form filling process. The first thing is, that the salary range will depend upon the Dubai bank, that you selected. Because it varies from bank to bank, some required 3000, some require 5000, and some 8000.

The next thing is your residential status and employment status, which will be considered the most essential factors during this process. For this purpose, show your visa, passport, ID card, trade license, driving license, pay slip, salary certificate, etc. Through your ID card bank will also check your original date of birth and your real age, which should be not less than 21 years.

Loan without Salary Transfer for expats in UAE

This is the most frequently asked question by the people of the UAE. The answer is, yes expats can also take advantage of residents to apply for personal loans without salary transfer. So, do not worry expats, and apply to UAE without any type of fear or hesitation.