Non-salary Transfer Personal Loan in Dubai

Availing of a personal loan without the need for salary transfer is an ideal financial solution for everyone in Dubai. Mostly, individuals choose it because their monthly salary is not fixed or they want to obtain a loan on the basis of salary transfer. Non-salary transfer personal loan gives you access to extra finances when you are in the situation of financial crisis. Personal loans can be used for any purpose such as debt consolidation, covering any financial expenses, etc. When you apply for this type of personal debt, you will not need to do the step of salary transfer that requires additional time for its paperwork. As a result, the application process is simpler without extensive paperwork.

Features of non-salary transfer personal loans

Due to the impressive features of this kind of personal loan, every borrower should select it to manage their financial issue very well. The interest rate of this loan is very competitive. Karz.ae does not only offer lower rates but this financial company also provides the option of repayment flexibility. After approval, the disbursal of debt amount is also quicker. Anyone with any profession can apply for it like employed, self-employed, etc. In particular, the common features are:

- The limit of the maximum amount of debt is higher as compared to credit cards. It means that you will easily receive the higher funds.

- Its repayment duration is flexible and the borrowers can repay the amount within 48 months

- If you are earning a high monthly salary and your employment history is good, there will be no restriction in obtaining higher debt.

- When banks offer this loan, they require the charges of life insurance. This insurance is for the covering of the outstanding amount of debt.

- Anyone living in Dubai including expats & nationals can apply for it.

- The monthly salary requirement is different in every lender’s terms. But the common criterion of minimum monthly salary is five thousand AED.

- This loan is much more flexible because you will not need to transfer your salary.

Application procedure for a Personal Loan with non-salary transfer

The application procedure is effortless work if you know the complete information on how to do it. This procedure includes the meeting of eligibility criteria and submission of all documents. And also, you should be aware of where to apply for it. Before applying, you can check the lender’s terms online also on their official websites. The company Karz.ae offers the best customer services for finances. They provide all the details of the application procedure, so when you apply, you will have confidence that you will get approval because of submitting the application with meeting all of their requirements.

Eligibility criteria to meet

Every applicant must know and meet the eligibility criteria in order to become an eligible applicant who will get quick application approval in a shorter time. The lender will never give you rejection of obtaining a loan if you meet their criteria. These criteria are different from one loan provider to others. But here we are mentioning some general ones:

Age:

In Dubai, every bank and online lender checks the applicant’s minimum & maximum age before providing the personal debt. This age limit starts from 21 years and the maximum goes to 60 years. However, some lenders also have a maximum age criterion of 65 years.

Monthly income:

Firstly, it is crucial that you are a professionally stable person. It means the unemployed person is not eligible to apply for it. Most banks provide personal loans if an individual is earning more than five thousand per month. However, some lenders have the criterion of a minimum salary of 8000 or 15000 AED.

Employment history:

It is also essential that your record of employment history is good if you need higher debts. Lenders verified your duration of working with the employer. The 18 months of employment period shows that you are working hard and sincere towards your professions. So, the lender also gets surety you will repay the payments within tenure without delay.

Check your credit score:

Check your credit score before applying because there are so many benefits of an excellent credit score in contrast to a bad score. It also makes a good credit history overall. There is a specific limit of minimum credit score and you have to meet it. If your score is good, you will get this loan with lower interest as well as with flexible repayments.

Requirement of documents to Apply

In addition to eligibility criteria, now check the requirements of the below-mentioned documents. These documents are mandatory to apply for this personal debt without salary transfer. There is no need for salary transfer, but all other documents must be attached to the application:

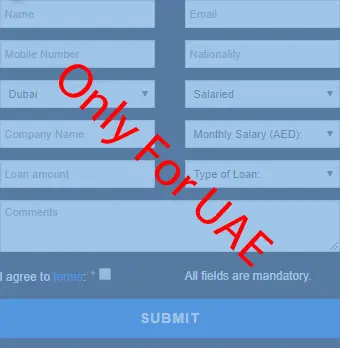

- Fill out the complete form that requires your personal details such as name, address, contact number, etc.

- Photocopies of Emirates ID, passport, visa

- The bank statements should be original and latest. Through the bank statements, you will give proof to a lender about monthly income.

- Some lenders also require the security cheque but many do not.

Where to apply for personal loans in Dubai with the benefit of non-salary transfer?

So many lenders are now working in the financial market to provide personal loans to borrowers. Financial institutions like banks and online lenders offer this debt with the benefit of no need for salary transfer. Karz provides the best guidance of applying process and its rates are very competitive. The lower rates make the debt repayments less expensive. Thus, the repaying of debt is not a tough task.