How Easy is It to Get Personal Loan in Dubai?

Are you interested to take a personal loan? but couldn’t find the way yet? No problem at all, because avail the personal loan in UAE is not a big deal yet. With time and with the advancement of the UAE, many things are changing and getting better day by day. Doesn’t matter in which Emirate of UAE you are living right now. All the branches of the UAE banking system are scattered here and there with the same unique features and characteristics.

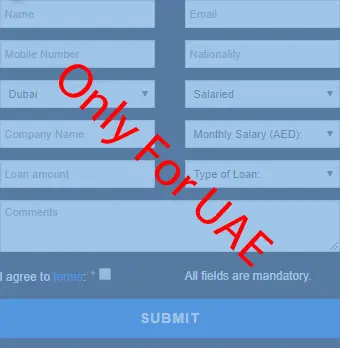

You can also get your required info on the websites of Dubai banks, where you may find each and everything about personal loans. Even if you apply through their website, it will be a perfect option for you. Especially, when you are living far away from the bank, where you are going to apply for a loan. For example, if your home or apartment is in Dubai but your selected bank is in Sharjah, so online application method will facilitate. Karz.ae is the best option to apply for a personal loan in Dubai because we are not taking any kind of charges.

You're at Right Place To Find Personal Loan in Dubai

This piece of writing is all about your outstanding topic of personal loans in UAE. so if you are searching about private loans, this is the right point, where you may find everything you want to know. We will tell you about the banking system of Dubai, its requirements, and eligibility with the best way to apply. We are going to tell you about the best options related to banks, that are giving such facilities with or without salary transfer. so you just read it carefully, because you reached the exact place. Now, let’s begin the journey of personal loans in the UAE.

In What Circumstances can Personal Loan help out People?

• Whenever someone is stuck in some kind of emergency, such type of loan will be a reasonable way to tackle that situation. Through this loan, most of people handle their private financial matters accurately. They may easily get rid of that critical situation with a cash loan.

• This loan is the biggest blessing for the students as well, because of its benefits. If any student wants to do some kind of study or course, this money will help out that student. For example, if a student living in Dubai, left their study because of a shortage of money and now wants to finish the degree. So, this money of personal loan in Dubai will be beneficial in this matter and he/she can finish the degree easily.

• It’s good news for the businessmen of UAE also because now they can handle all types of business issues. They can easily resolve financial affairs with the income of personal loans. The banking system of the UAE will not impose any strict restrictions or limitations on small-scale businessmen. Small entrepreneurs can also take advantage equally with large-scale business operators, they can also enjoy every facility with other famous business owners.

• If anyone has a wedding at their home but they don’t have enough amount in their account, don’t worry, just apply for such a loan. So, this personal loan in UAE will also help them to maintain all marriage ceremony expenditures, that they can not handle alone. Even if you need to give some wedding gifts or want to buy some dowry, this loan can make it easy for you.

• The next most important thing is your expenditures associated with the hospital. In that case, it will make you happy and healthy because everything can be managed accurately via the money of loan. if anyone needs the medicine and drips that are much more expensive, they can easily maintain for the whole month through this amount.

Personal Loans for Listed Companies

The scenario behind the listed companies is that these are the best companies in handling all kinds of business affairs. In simple words, a listed company means the company that attained a high-level position in the field of business and finance. Getting a loan is not a problem for such types of companies because Dubai banks will easily allow the loan to listed companies.

Now the most important question, that most people ask is, how can we know whether our company is listed or not? So, the answer is that you have to check the details via their given calling numbers or via their websites. Call the closest branch of the bank and ask about your company, bank will fit in their list and will inform you later.

Qualities of Listed Companies for Avail the Personal Loan

• The first quality is that the company must be a good reputation company.

• if the company earned financial value in the market, the investors and other businessmen know it very well, so it will consider the best.

• The company should be famous due to its name and due to its products. That means it will not disturb the bank's installment due to its good earnings.

• The company should produce good output in the form of heavy income. So, the bank will allow personal loans for listed companies.

• If your company consists of a huge number of staff members, it will be also a plus point for you.

• With all these above-mentioned qualities, if your company is legal, registered, and doing work for many years. so it will be included in the list of banks in UAE, this process will happen automatically.

Personal loan interest rates

• First of all, personal loan rates of interest depend on the various financial institutions and banks, where you want to apply for a loan.

• In UAE, there are popular rates are just two, that banks are giving to their consumers. One is known as the fixed or constant rate, in which the bank will fix the specific rate, and that rate will remain the same.

The second one is variable or reduced rate, in which after paying the first installment, the rate will decrease step by step.

• All the rates are set by the banks and all these personal loan interest rates are according to the amount of the personal loan.

• The best lowest rates you will find in the Islamic banks of UAE because they all are working based on strict sharia laws. These rates start from 1% to 5%.

What Kind of Things is very Important for a Personal Loan?

You need to prepare your all personal papers related to your private data, business, and financial matters. The following things are as mentioned below:-

• Emirate ID

The first essential thing that bank will ask is your valid identity card of the United Arab Emirates. Whether you’re an ex-pat or not, you have to show that card in front of the bank.

• Bank statements

Prepare your all bank statements, in which credit history will be notified by the bank.

• Experience

Bring the slip of your job or work experience, which is up to 2 to 3 years minimum.

• Proof of residence

It is also a very important part, to show the recent address of your home.

• Visa copy

This part is specifically designed for ex-pats, their copies of visas and passports are very vital.

• Pay receipt

Attach your pay slip with the form, the salary range will be between 3000 to 7000 AED.

How many ways we can apply for a personal loan in UAE?

• Through banks

Visit your closest branch of the bank and apply in a regular formal way. In Which, a hard copy of the application form will be provided to you by the bank and you have to fill out and submit it.

• Through an online website

Secondly, apply through karz.ae the fastest way of online website. Fill out your data on the available online form and submit.

• Through Mobile Apps

By downloading the Various mobile apps of banks, you can easily apply for a personal loan with one click.