Which Bank is Best for Personal Loan in UAE?

Within many loans, the personal loan is the only loan that is more in demand and provides proper financial assistance to everyone. Due to its increasing demand, the banks are providing some specific rewards and benefits with this personal loan service. So that every individual can obtain those advantages and through all these tricks people are getting more attracted towards this loan. There are lots of sources that are busy in providing all loan services in the UAE including personal loan. But the one question that is mostly asked by the people is which bank is best for personal loan in UAE?

Such questions are usually raised by the all people living here involving outsiders. Because they want to know a bank that can provide them a personal loan with the lowest interest. Also a relaxing repayment duration and with easy installment package. To disclose the fact about such a bank, we are here. This article is entirely based on research and will give you authentic knowledge about the best bank and the features of that specific best bank. Therefore, you shouldn’t have to worry about that and stop finding now, which bank is best for a personal loan in UAE.

Features of Best Bank in UAE

• Flexible duration

The best bank has the trait of flexible duration, which means the time limit for the installments each month will be relaxing. The amount of these repayments is the sort of thing that will not put a heavy burden on the candidate's head. The installment amount should be easily payable and the gap in total duration will be satisfying. The normal range of personal loan duration will be up to 48 months. That will be considered the adequate period.

• Sufficient amount of loan

Another quality of the best bank is the sufficient amount of loan. Although there are several banks over here that are giving sufficient amounts there should be a bank that can give you a suitable amount. Normally, the best bank should provide enough amount to both locals, the residents, and non-residents. Normally the amount of loan depends on banks and the portion of non-residents is half as compared to residents. There are many reasons behind this half-portion strategy.

• Low interest

Another major feature associated with the best bank is the lowest interest rate. People usually want that kind of bank that can give them the lowest interest rate because they don’t want to pay a high rate of interest. For such purposes, they mostly search about such kinds of banks, like which bank is best for personal loans in UAE. They see the huge list of banks over there, in which they select the top best bank in UAE.

• Easy accessibility

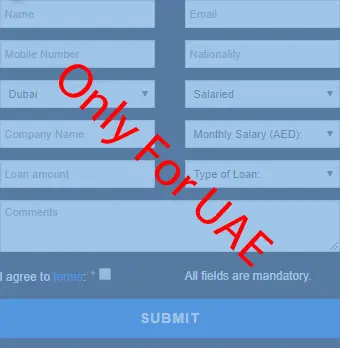

The best bank has the quality of easy accessibility, which means it should be comfortably obtained via various sources. Accept banks there are other sources also available in UAE. Like online sources and mobile app sources that can authentically give personal loan services.

Name of the Best Bank in UAE with the Eligibility

According to the survey, most people prefer Emirates NBD, which is a well-known bank and famous for its amazing personal loan service. This bank is incorporated with another bank and now it is known as the most advanced bank with the qualities of two major banks. The amount of personal loan for UAE residents is almost 4 million and on the other side, expats can attain a personal loan of up to 2 million. The age factor is the same for both, it will be from 21 to 65 years.

If you are interested in taking a personal loan from Emirates NBD then Karz.ae can help you without any cost.